When you depreciate belongings, you can plan how much money is written off every year, giving you more control over your funds. Oblique bills like utilities, financial institution charges, and rent are not included in COGS—we put those in a separate category. Get free guides, articles, instruments and calculators to help you navigate the monetary aspect of your corporation with ease. The magic happens when our intuitive software program and actual, human help come collectively. E-book a demo today to see what working your corporation is like with Bench.

![]()

(The depreciation journal entry features a debit to Depreciation Expense and a credit to Amassed Depreciation, a contra asset account). The function is to allocate the fee to expense to have the ability to comply with the matching precept. In other words, the quantity allotted to expense isn’t indicative of the economic value being consumed.

Most businesses have some expenses associated to promoting items and/or services. Advertising, promoting, and promotion bills are often grouped together as they are similar expenses, all related to selling. Similarly, for an organization (or its franchisees) in the business of providing providers, revenue from primary activities refers to the income or fees earned in change for offering these services. The retained earnings account is equal to the prior interval steadiness, plus net revenue, and minus any dividends issued – as mentioned earlier.

Study how to build, read, and use financial statements for your small business so you can make extra informed selections. Here is an instance of tips on how to put together an earnings statement from Paul’s adjusted trial stability in our earlier accounting cycle examples. They use competitors’ P&L to gauge how properly other firms are doing in their house and whether or not they should enter new markets and attempt to compete with other corporations. An assumption that determines the order by which costs should circulate out of a steadiness sheet account (e.g. Stock, Investments, Treasury Stock) when the item is offered. For an illustration of the cost move assumption, see Explanation of Stock and Price of Goods Bought.

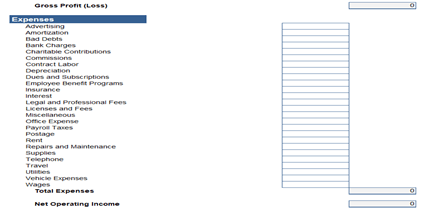

What Is The Revenue Statement?

For example, they use performance numbers to gauge whether or not they should open new department, close a division, or enhance manufacturing of a product. A report in the basic ledger that is used to collect and store comparable information. For example, an organization may have a Money account by which every transaction involving money is recorded. A company promoting merchandise on credit will document these sales in a Sales account and in an Accounts Receivable account. The subtotal tells the reader the amount of revenue that is obtainable to cowl the $20,000 of frequent fixed expenses. Frequent bills means they have to be arbitrarily assigned to the product strains.

If you subtract all the outgoings from the money the company acquired, you are left with $21,350. The firm also realized a net gain of $2,000 from the sale of an old van and incurred a lack of $800 for settling a dispute raised by a client. The change in net working capital (NWC) captures the distinction between the prior period and present period web working capital (NWC) steadiness. The real cash outlay, Capex, already occurred and was recognized within the money from investing section (CFI) within the interval of occurrence. In the PP&E roll-forward schedule, remember to maintain consistency throughout the mannequin and pay shut consideration to the formulas.

Buyers

With 7.433 billion outstanding shares, Microsoft’s primary EPS got here to $13.70 per share ($101.eight billion ÷ 7.433 billion). The Revenue part reveals that Microsoft’s gross margin, also recognized as gross (annual) revenue, for the fiscal year ending June 30, 2025, was $193.9 billion. This quantity is arrived at by deducting the price of income ($87.eight billion) from the total revenue ($281.7 billion)—in other words, revenue minus the amount it costs to provide that $281.7 billion. These are all expenses that go toward a loss-making sale of long-term property, one-time or any other uncommon prices, or bills towards lawsuits. Income realized by way of main activities is sometimes called operating income.

Income Tax Expense

This is the company’s revenue earlier than deducting the price of revenue tax. You calculate it by adding or subtracting interest from the operating revenue. Working expenses differ from costs of sale in that the company can not instantly hyperlink these operating expenses to the manufacturing of the products it sells. These steps solely note the actions required to manually shift earnings assertion data from the trial steadiness to a manually-prepared revenue assertion. All accounting software program has a standard earnings assertion report that mechanically presents the knowledge famous within the previous steps. The lease starts on the first of the month, however the rent isn’t due until the fifteenth.

- The amount of other complete earnings is added/subtracted from the stability within the stockholders’ fairness account Amassed Other Complete Revenue.

- The change in internet working capital (NWC) captures the distinction between the prior period and current period web working capital (NWC) stability.

- In the case of a sole proprietorship, the web earnings reported on the income statement will enhance the owner’s capital account, which is part of owner’s equity.

- It known as the single-step earnings assertion as it’s based mostly on a easy calculation that sums up revenue and gains and subtracts expenses and losses.

Revenue is lowered by any discounts or refunds given, as properly as by returns, to calculate internet gross sales. An earnings statement is certainly one of your company’s monetary statements. It’s a key software https://www.simple-accounting.org/ for running your business and planning your technique. You can calculate the gross revenue margin by dividing the gross revenue by income. This tells traders how much profit a business makes on every sale.

The promoting, basic and administrative bills are commonly known as SG&A. In the us, a company can select from several value flow assumptions when calculating its value of gross sales and ending stock. Nevertheless, the corporate cannot change cost move assumptions greater than as quickly as. Except for small firms, the amounts shown on the income statement are likely rounded to the closest thousand or million dollars (along with a notation to inform the reader). In Microsoft’s case, in 2024 it earned $174 million in interest, an indication of the company’s stability sheet strength.